Bitcoin is a recent technology for money (2009) designed to allow anyone anywhere to be able to transact with others without permission, censorship, control, or confiscation. Its core essence is math, cryptography, and work designed to record and secure a permanent record of ownership and every transfer of ownership since the beginning of bitcoin. And it is a whole lot more.

- A “whole” bitcoin is actually divided into 100 million parts, each called a satoshi or sat. You do not need to buy a whole bitcoin, or spend a whole bitcoin. You can exchange $1.00US into about 2,300 sats on March 1 2022.

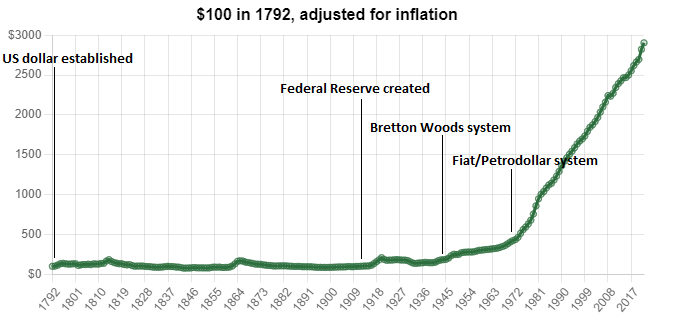

- Bitcoin is engineered to be scarce with a maximum of 21 million bitcoin. So, it is designed that over time, if bitcoin continues to prove valuable, you’d be able to exchange FEWER sats for the same item you wanted (whether a meal or a house) over long time periods. (Yes, this takes awhile to get our head around since our dollars, euros, and other fiat currencies were designed to be inflationary where things cost “more” over time.)

- When people talk about bitcoin, they can be referring to both the asset (how many sats someone has the keys to), or the network (how ownership is passed).

- The lightning network is build “on top of” the bitcoin network to allow sats to move anywhere in the world instantly at very low cost.

Money is a technology. It was immensely useful when it came about many thousands of years ago, and it has become essential to modern civilization. The money we use impacts what we can and cannot easily do in profound ways. For example, it would be hard to pay for Netflix using gold.

There are dozens of excellent books on bitcoin and money that I’ve read in the past year. I’ll be adding to this topic with quotes and links to those books over time. There are some amazing online resources, too, as well as thought leaders who have been with bitcoin as an asset and as a technology since early on – or who have joined this effort recently.

There’s no way a topic here can replace all that knowledge, so why start an exploration here? Well, I believe that how money serves a community has a lot to do with the needs and desires of that community! Freedom-loving people are going to have a different perspective on money than those who are playing “the game of money.”

You needs and desires may be quite different from mine. I invite you to consider what yours are, ask questions about how bitcoin might fit into meeting those needs long term, and how other money and assets might also enhance your thriving.

I do recommend the workshop Get Strong and Clear About Money as one entry point for that, to help clear the noise and gain some clarity.

Before we begin, because of legal and trust needs, please no that none of this – by me or anyone else – is designed to tell you what to do. It is neither financial advice or “what you should do.” If you find yourself thinking, “Oh, they are telling me I should…” then… STOP! Not just pause. STOP. Why? Because since money touches everything in our lives, it is truly crucial that you feel the choices you have and know what is right for YOU. Whether buying a home or stock or shifting energy into bitcoin, these are choices we assert are important enough to get your mindful clarity and take inspired action from that place. While bitcoin is indeed an opportunity to do money differently, like the wheel or the internet, it’s engineered for a LONG term utility. If it continues to prove itself, it would be just as useful and even more valuable to humanity 10-100 years from now.

So let’s begin! Your questions? And do share resources you find useful, too!